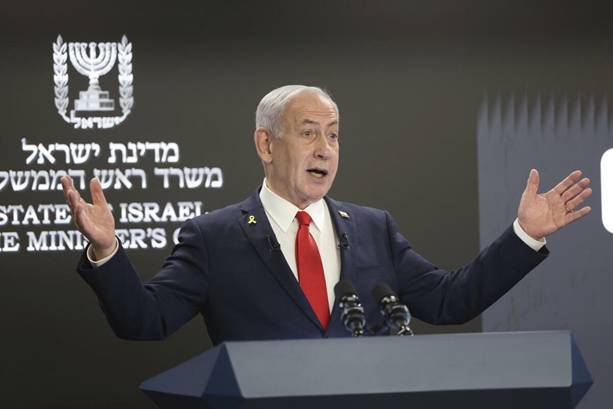

GO HERE FOR MORE www.zerohedge.com/geopolitical/netanyahu-if-we-wanted-commit-genocide-it-would-have-taken-exactly-one-afternoon

[image: https://assets.zerohedge.com/s3fs-public/inline-images/bibigazaoffensive.jpg?itok=mtdU-Fx3]

THE PROPHETIC NEWS SERVICE by MESSIAH’S BRANCH is an independent t NEWS & RESEARCH MINSITRY FUNDED only by your kind donations, ANY SIZE DONATION HELPS GREATLY, Please go here to donate! prophecyhour.com/donations/ WE ALSO HAVE A MISSION CHURCH FOUND HERE wichitahomeless.com/

[image: https://assets.zerohedge.com/s3fs-public/inline-images/bibigazaoffensive.jpg?itok=mtdU-Fx3]

THE PROPHETIC NEWS SERVICE by MESSIAH’S BRANCH is an independent t NEWS & RESEARCH MINSITRY FUNDED only by your kind donations, ANY SIZE DONATION HELPS GREATLY, Please go here to donate! prophecyhour.com/donations/ WE ALSO HAVE A MISSION CHURCH FOUND HERE wichitahomeless.com/